Is Gap Insurance For You?

If you are a New York driver with an auto loan, you might consider purchasing gap insurance. Although it is not a required coverage, gap insurance can offer valuable financial protection if you owe a significant amount on your vehicle loan. Bankrate will review what you need to know about gap insurance in New York: what it is, where to buy it and the kind of coverage it can offer.

What is gap insurance?

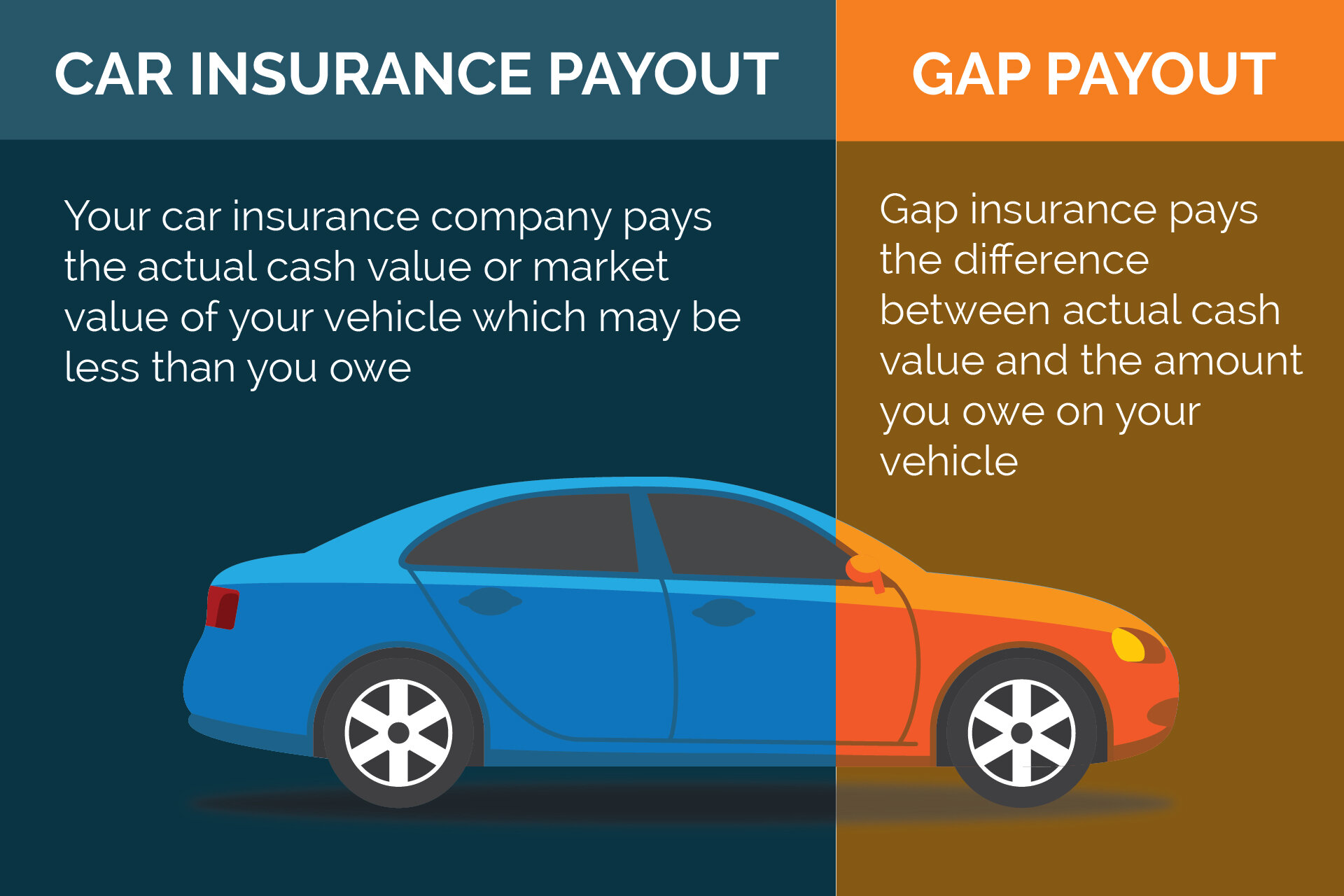

Gap insurance, or guaranteed asset protection insurance, is a type of auto insurance coverage. It covers the difference between what you owe on your auto loan and the actual cash value (ACV) of the car if there is an accident where the car is deemed a total loss. Typically, insurance will only reimburse you the ACV of your vehicle minus your deductible. If that amount is less than what you owe on the loan, you would normally be left to cover the remainder of your auto loan on your own. With gap insurance, you have coverage for the entire amount, even if the ACV is less than your remaining loan balance.

How does gap insurance work in New York?

You can only purchase New York gap insurance if:

- If you are the original loan/lease holder

- The car is less than two to three years old

- You have both comprehensive and collision on the vehicle

It’s not uncommon for new car buyers to assume that having a loan or lease on a vehicle is the only prerequisite to obtaining gap coverage. However, the car must also meet other criteria as well.

Another misconception is that gap coverage is the same as new car replacement. This is not true, either. Gap coverage only pays the difference between a car’s depreciated value (or ACV) and your remaining loan amount; it will not give you the funds needed for a new purchase. That’s not to say that gap insurance cannot still be useful. By not having as much debt to your name, you will be more likely to be approved for a new loan.

When do you use gap insurance?

Gap insurance in New York only activates if the car is deemed a total loss and undrivable. This means that for minor bumps and scrapes, gap insurance doesn’t come into play. The vehicle must either be stolen or totaled for gap insurance to pay your remaining loan amount.

Gap insurance is most easily understood with some examples. Below is an example when gap insurance would apply, and one where it would not:

Example 1:

You financed a $25,000 car one month ago. After a severe storm, you awake to find that a tree has fallen over and crushed your vehicle. Because it is demolished beyond repair, an insurance adjuster considers it a total loss. Your comprehensive coverage plan provides you with a payout of $20,000, which means you still owe approximately $5,000. By having gap insurance in this scenario, the outstanding $5,000 is also taken care of.

Example 2:

You recently financed the purchase of a $25,000 car. Because you didn’t pay for the vehicle outright, your lender required you to purchase both full coverage and gap coverage. After parking on the side of the street, an oncoming car knocks off a side mirror and scrapes the door up a bit. You contact your insurance company, which informs you that you are covered because you have collision coverage. However, you decide you want more than the repair amount and instead, seek the full $25,000 to start anew. Gap insurance would not kick in in this scenario because the car is still driveable.

Gap insurance vs. other coverages

With so many types of coverage available, gap insurance can feel similar to other insurance types in that it activates after a covered peril takes place. It is unique, however, in that it requires both comprehensive and collision coverage to be purchased before it can take effect. Gap insurance also does not pay for any repairs; it only usually kicks in if the car is totaled or stolen.

The table below explains how gap insurance compares to both comprehensive and collision coverage:

| Gap insurance | Comprehensive | Collision | |

|---|---|---|---|

| What it covers | Financially protects you if your car is deemed a total loss after a covered peril. DOES NOT pay for repairs or replacement. Only pays for the difference between an ACV and remaining loan amount. | Pays for repairs or replacement if your car is damaged outside of a collision or after an animal, such as a deer. Incidents such as fires, falling tree limbs or flood waters are all covered under a comprehensive plan. DOES NOT pay for any discrepancy between an ACV payout and remaining loan amount. | Pays for repairs or replacement after your car is damaged in a moving accident. Incidents such as hitting another vehicle or running into a tree or fence are covered under collision coverage. DOES NOT pay for any discrepancy between an ACV payout and remaining loan amount. |

| Who offers it | Many insurance companies offer gap coverage, but they may call it loan/lease coverage instead. It is also possible to purchase it through an auto dealership. | Comprehensive coverage can be purchased with most insurance providers. | Collision coverage can be purchased with most insurance providers. |

Where to buy gap insurance in New York

Gap insurance is not usually offered through a typical insurance package. In most cases, It must either be added on to an existing policy or purchased separately. Many gap insurance providers offer it as an add-on, but some don’t. While you’re searching for it, remember that gap insurance may also be referred to as loan/lease coverage. However, the coverage works the same under either name.

Buying gap insurance is also possible through most dealerships. However, when you do this, it’s often put onto the loan itself, which means you’ll pay interest on it. Unless offered as a standalone option, meaning you just pay for it upfront, purchasing gap insurance through a dealership may not always be your best option. However, keep in mind that many factors may affect the cost of car insurance.

Gap insurance companies in New York

If you’re wondering about where to buy gap insurance in New York, there are plenty of options. Some of the most popular providers include:

- Allstate — Allstate is the fourth largest insurer in the U.S. Including gap coverage, Allstate has add-on coverage options as well as 10 discounts most drivers can take advantage of either now or in the future.

- Liberty Mutual — If you have several coverage needs, Liberty Mutual has many options. It also has a healthy amount of discounts, too.

- Nationwide — Nationwide is often one of the cheapest providers for many drivers and tends to score well with J.D. Power for customer satisfaction. If you’re already with Nationwide, consider speaking with an agent about adding gap insurance to your policy. It’s possible adding the coverage won’t increase your premium by too much.

- Progressive — Progressive sells just about any type of insurance you could possibly need, including gap coverage. Like many insurance providers, it calls it loan/lease coverage instead of gap coverage.

- Travelers — Travelers may be one of the more expensive options on this list, but it is still a popular provider. Many drivers like Travelers because of its highly customizable policies.

These are just a few of the best auto insurance providers in New York. Always compare quotes to find the cheapest coverage.

Frequently asked questions

-

- How much is gap insurance?There isn’t a set amount because many things affect the cost of gap insurance. The main factor, of course, is your loan amount compared to the car’s ACV. However, other factors that can influence the cost of your car insurance (gap insurance included) include your age, claims history, location and credit score.

- Is gap insurance required in New York?New York state law doesn’t require you to purchase gap insurance. However, if you finance or lease your new car, your lender or dealership will likely require you to get it.

- How do you cancel gap insurance?The process for canceling gap insurance may vary, but you should generally contact your insurer directly. This might be the car dealer where you purchased the vehicle, or a separate company where you bought the policy. You must then follow the company’s cancellation procedure, which may include a written request, though requesting a cancellation over the phone may be sufficient. If you are canceling before the end of the term, you may be entitled to a partial refund, but this isn’t always the case.

- What is standalone gap insurance?Standalone gap insurance is a gap insurance policy you purchase separate from any other policy or product. For example, if you lease a vehicle, the dealer may require you to purchase gap insurance along with a full coverage policy. However, if you buy a car outright without gap insurance and decide to purchase it later, you would be purchasing standalone gap insurance.