Average credit score in the US climbs to 715 in 2023: Here’s why that matters

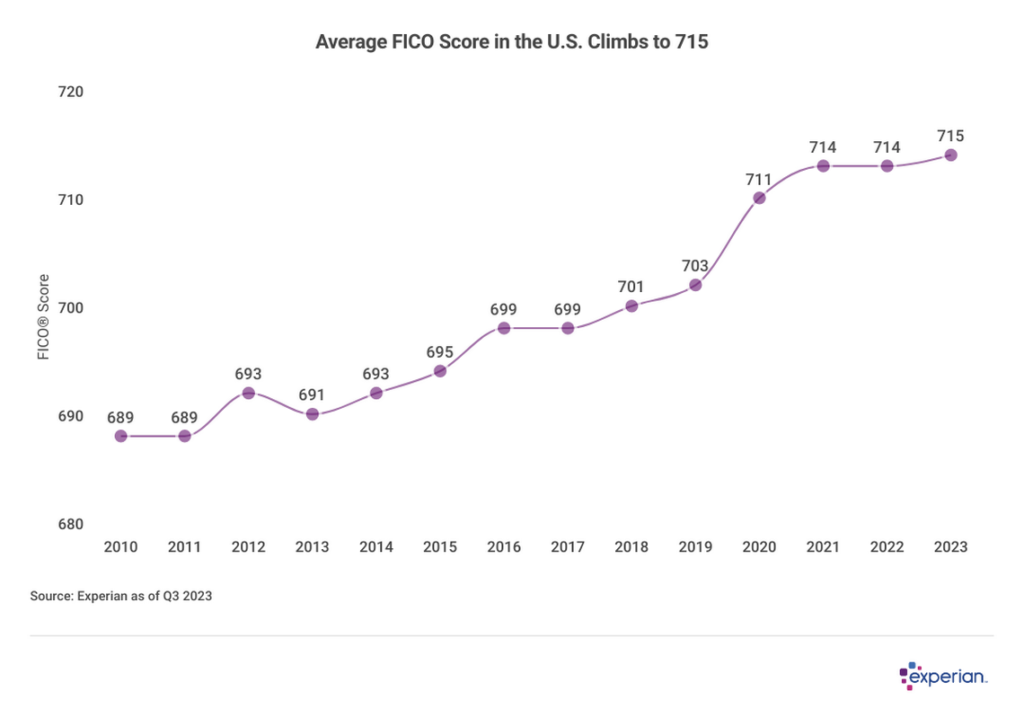

The average FICO Score in the United States was 715 in 2023, according to Experian data, increasing by one point from its 714 average in the third quarter (Q3) of 2022. It marks the tenth consecutive year that average FICO Scores in the U.S. haven’t decreased on an annual basis. The last annual decline occurred in 2013.

Here are some of the key consumer credit highlights of in 2023:

- Despite economic headwinds, consumer finances remained strong.

Except for the anomalous-in-every-way recession sparked by the pandemic in 2020, economic growth, near-full employment levels, lower delinquency rates, and lower debt service obligations, as well as a more informed consumer borrower, have all played a role in the average FICO Score increases over the past decade.

- Consumers are now largely aware of the importance of credit scores.

Many financial transactions most consumers engage with—such as auto financing and credit card purchases—depend on credit scores to qualify and participate. The economic turmoil of the past few years has caused some consumers to take a renewed interest in their personal creditworthiness (more on that later).

- Credit scores continue to tick upward (for now, at least).

While an average FICO Score on the upswing can indicate, in very broad terms, that consumers have fared well in recent years, it doesn’t necessarily mean that average score increases will persist indefinitely.

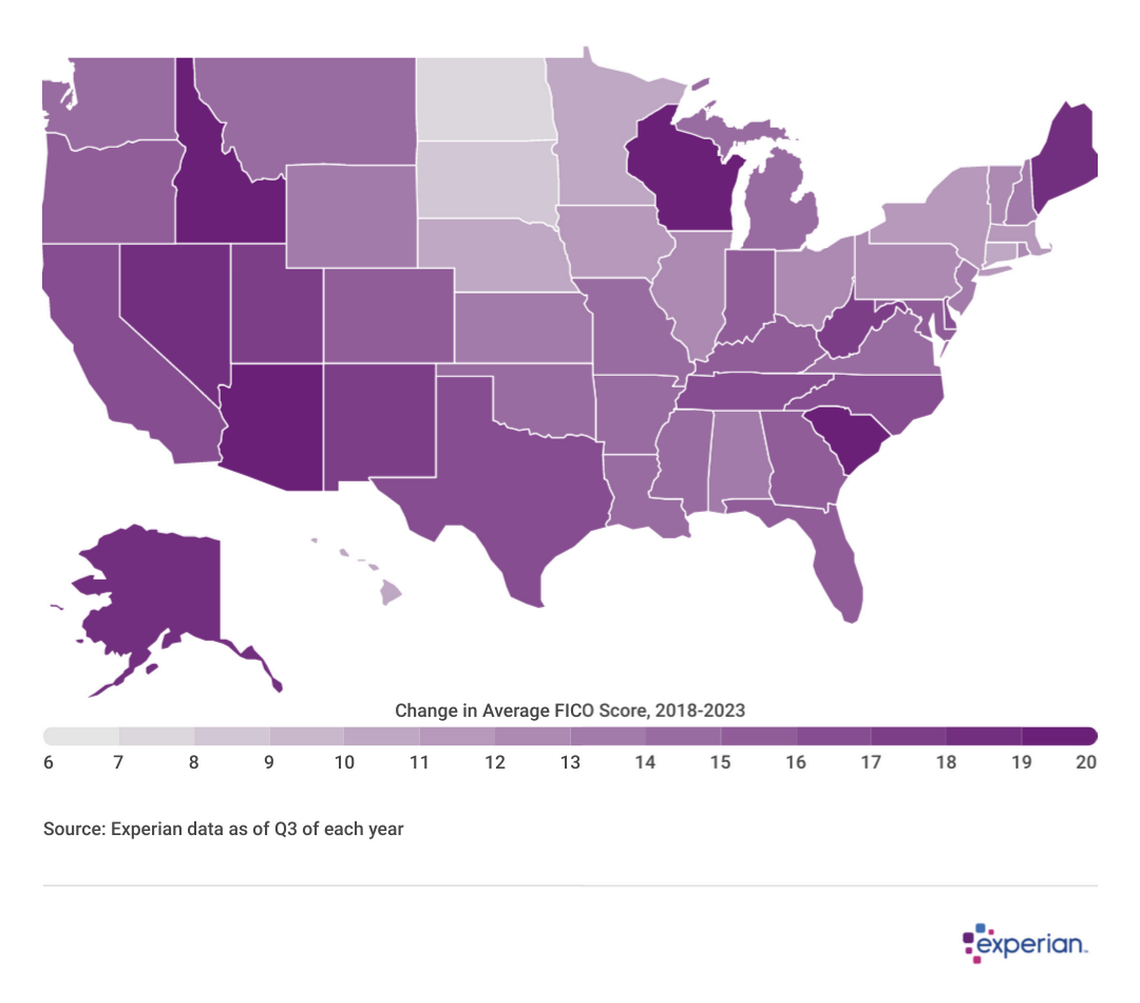

Since 2013, the average credit score has risen nearly 25 points

Despite the slight increase over the past 12 months, average FICO Scores have meandered throughout 2023, with average scores increasing from 714 to 716 this past summer, before settling at 715 at the end of the Q3 2023. Nonetheless, average balances for most types of loans, as well as both fixed and variable rates on those loans, have increased sharply as the Federal Reserve attempted to keep the lid on inflation by raising the key fed funds rate throughout 2023

Average credit scores by age increase slightly for most

FICO Score increases were broadly distributed among the generations, with only the Silent Generation not showing an increase in their average FICO Score over the past year. Other generations notched a one-, two- or three-point increase in 2023. On average, younger generations have scores that are considered good, while the average scores of the two older generations are considered very good to lenders. Although a consumer’s age isn’t considered in determining a FICO Score, the length of their credit history is a factor, as the scores above neatly illustrate. Seniors likely have accrued years of credit history, while Generation Z is just getting started on their financial journeys.